Micro art over swan feather

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over pumpkin seed

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over bee

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over butterfly

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over cashew

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over sunflower seed

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over feather

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over pocket watch

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over rice

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

Micro art over noodles

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

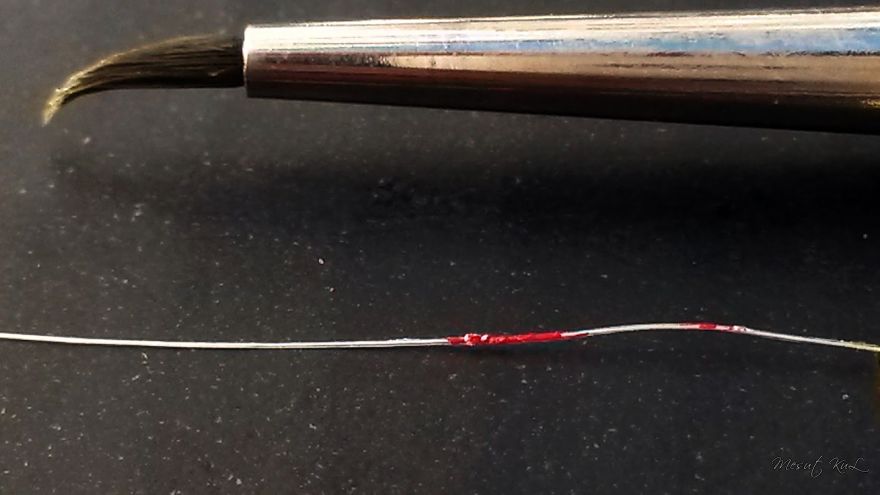

Micro art over hairline

Source: mesutkul.com

The Art of Mesut Kul – Micro Art

KERALITES - A moderated eGroup exclusively for Keralites...

To subscribe send a mail to Keralites-subscribe@yahoogroups.com.

Send your posts to Keralites@yahoogroups.com.

Send your suggestions to Keralites-owner@yahoogroups.com.

To unsubscribe send a mail to Keralites-unsubscribe@yahoogroups.com.

Homepage:

http://www.keralites.net